CPLEA has recently updated the information on Adult Interdependent Relationships at Canadian Legal FAQs.

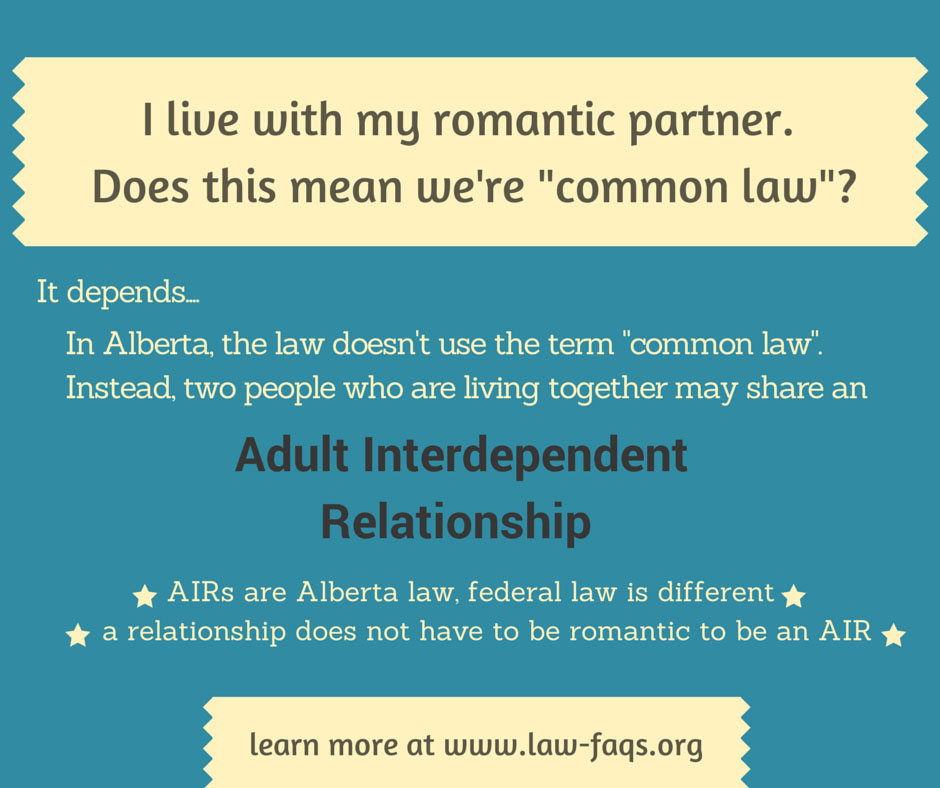

In Alberta provincial law doesn’t use the term “common law” to describe two people who are living together but are not legally married. Instead, two people who are in a committed domestic relationship in Alberta can be in an Adult Interdependent Relationship (AIR).

Most people in AIRs are romantic partners, but the relationship does not have to be romantic to be an AIR. An AIR consists of two people who have been living together for a certain length of time, share one another’s life, function as an economic and domestic unit, and are emotionally committed to one another.

To learn more about AIRs, go to Canadian Legal FAQs or download and print this booklet about AIRs in Alberta.

New FAQs on Consumer Protection in Alberta

What are collection agencies and collectors allowed (and not allowed) to do?

What’s the difference between an open credit agreement and a fixed one?

What information cannot be included in a credit report?

You can find the answers to these questions and more on Canadian Legal FAQs.

There can be a lot of questions when people are dealing with consumer issues. In Alberta, consumer transactions are governed under the Fair Trading Act.

The Act covers a variety of different areas and provides rules and regulations that set out what businesses can and cannot do in their interactions with consumers. It also provides a way for consumers to challenge a transaction with an offending business and to be awarded a remedy, such as cancellation of a transaction, payment of damages, and others.

Two major areas of focus of the Fair Trading Act are Collection and Debt Repayment and Cost of Credit Disclosure.

CPLEA has created new FAQs on Consumer Protection to help Albertans understand what the law says about:

- The Fair Trading Act

- Collection and Debt Repayment

- Cost of Credit Disclosure

- Credit and Personal Reports

For more information about organizations that can provide information and assistance around issues facing consumers in Alberta, check out CPLEA’s LawCentral Alberta.

Gift Certificates and Gift Cards: Receipt or no Receipt?

Gift certificates and gift cards are becoming a very common item in our culture. They are also becoming increasingly common in charitable activities. If your charity has ever received a gift certificate or gift card as a donation, listen up!

Charity Central (always on top of what’s happening in charity law) has several FAQs designed to help you understand when a registered charity can and cannot issue a donation receipt for gift certificates or gift cards:

Our charity received a donation of a $100 gift certificate from an aesthetician for a facial. How much should the receipt be for?

Zero. Your charity cannot issue an official donation receipt because there is no transfer of property. The gift certificate is for services and services are not property.

Our charity received a donation of a $100 gift certificate from someone who purchased the gift certificate from an aesthetician. Can we issue an official donation receipt and for how much?

Short answer

Yes, an official donation tax receipt can be issued for $100, the fair market value of the gift certificate.

Long answer

A gift certificate that was bought from the person who created the gift certificate is considered property. When the purchaser donated the certificate to your charity, there is a transfer of property. An official donation receipt can be issued.

If you have more questions about receipting, Charity Central has a wealth of information for you. Check out the information map, learning modules, more FAQs, and resources.

The Canada Revenue Agency has recently posted its updated policy on the donation of gift certificates or gift cards. Click here to read the policy from CRA.

A Question about Lawyer’s Fees and Retainers

Question of the month from the Garvie Reading Room:

I need a lawyer to help me with a situation, so I met with one the other day. The lawyer said that before she would do any work on my case, I would have to pay her $3,000.00 as a retainer. Why should I have to pay her when she hasn’t done anything yet?

A retainer fee is a way of assuring both you and your lawyer that the money will be available to cover your legal fees and any other costs associated with your legal action. You pay a lump sum which is then deposited in a trust account. As the case proceeds, your lawyer will bill you and take money from the trust account for her fees and specified costs (e.g. photocopying, court application fees etc.). If the retainer is used up before the case is completed, you will probably have to pay to top up the account so that the legal work can continue. If there is any of the retainer money left when your case is done and all the fees and costs have been paid, then you will get that money back.

You can find more answers to questions about retainer fees and retainer agreements at Canadian Legal FAQs.

Lawyers charge for services in different ways depending on the type of service being provided and the complexity of the situation. Articles about understanding lawyer’s fees are provided by the Law Societies of BC, Alberta, and Saskatchewan as well as the Nova Scotia Barrister’s Society.