CPLEA has a collection of new resources on employment law for youth in Alberta.

Funded by the Human Rights and Multiculturalism Fund, this project was created as a way to connect new Canadians with information about their rights at work.

This project was guided in part by our previous research on Law for Alberta’s Multicultural Communities.

We spoke with newcomer youth and agencies that work with them to find out what information about employment law the youth and their families need. In many newcomer families, children act as intermediaries to pass on information, including legal information. When youth learn about their rights and responsibilities, they are not only empowered themselves, they are also able to pass the information on t o other people in their families and communities.

o other people in their families and communities.

When talking with the youth we heard many different scenarios and most ended with the question “Can my boss do that?” The resources we created provide answers to that question.

A variety of formats, including infographics, videos, articles, and quizzes presents the information in interesting ways and allows us to reach people of different learning styles.

The collection of resources can be found on the CPLEA website: Your Rights at Work

New CPLEA website! Laws for Landlords and Tenants in Alberta

CPLEA is excited to announce the launch of our redesigned Laws for Landlords and Tenants in Alberta website.

The new website features a modern, streamlined design with enhanced searching capability and the same excellent plain language content that Alberta tenants and landlords have come to expect from CPLEA.

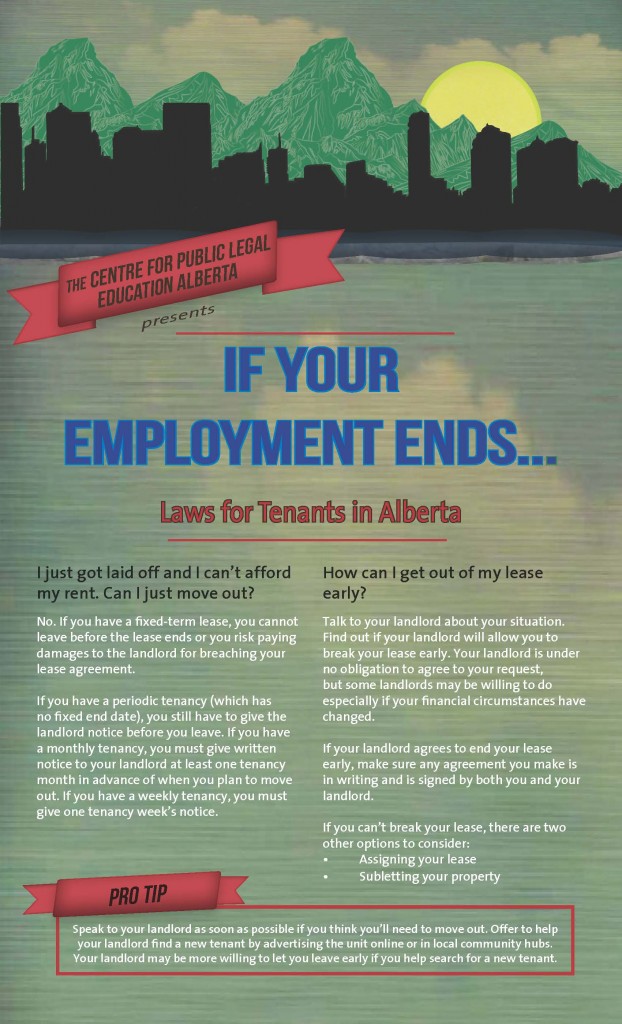

The new website also features CPLEA’s brand new tip sheet for tenants who have lost their jobs due to the economic downturn and dropping oil prices. If your Employment Ends… Laws for Tenants in Alberta explains what options tenants have if they can no longer afford their rent and want to move out early.

CPLEA’s Laws for Landlords and Tenants in Alberta program, including the redevelopment of the website, is generously supported by the Alberta Real Estate Foundation.

New Tip Sheet for Tenants: “If Your Employment Ends”

With oil prices dropping significantly and Target closing its doors, thousands of Albertans have lost their jobs.

Many thousands more are worried everyday that they could lose their job.

Here at CPLEA, we can’t fix the economy, but we can help people understand the law. We have created a new tip sheet for Alberta tenants who are having trouble keeping up with their rent due to the economic downturn. If your Employment Ends… Laws for Tenants in Alberta, explains what options tenants have if they want to move out early.

For Albertans who own their homes and are thinking of finding a tenant to supplement their income, CPLEA’s free booklet Renting out a Room in your Home provides key information on the laws surrounding such living arrangements.

CPLEA’s Laws for Landlords and Tenants in Alberta program is generously supported by the Alberta Real Estate Foundation.

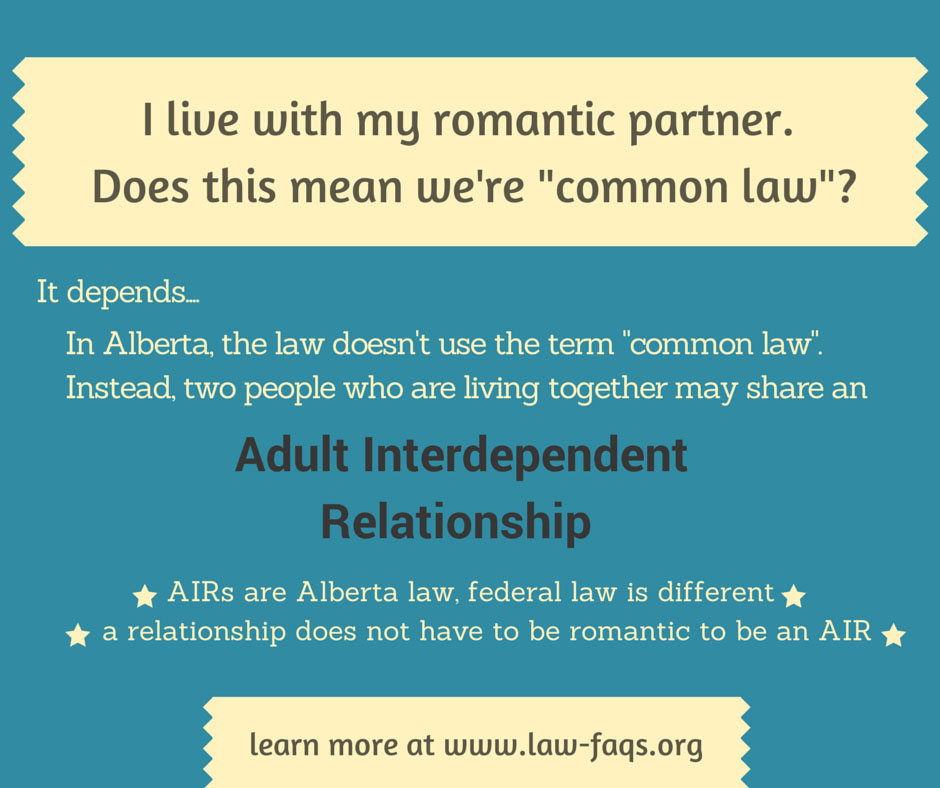

Updated Canadian Legal FAQs on Living Together in Alberta

CPLEA has recently updated the information on Adult Interdependent Relationships at Canadian Legal FAQs.

In Alberta provincial law doesn’t use the term “common law” to describe two people who are living together but are not legally married. Instead, two people who are in a committed domestic relationship in Alberta can be in an Adult Interdependent Relationship (AIR).

Most people in AIRs are romantic partners, but the relationship does not have to be romantic to be an AIR. An AIR consists of two people who have been living together for a certain length of time, share one another’s life, function as an economic and domestic unit, and are emotionally committed to one another.

To learn more about AIRs, go to Canadian Legal FAQs or download and print this booklet about AIRs in Alberta.

Can a landlord charge a tenant for renovations?

I just got a question from a tenant. The landlord replaced all the windows in the rental property, and then gave the tenant a bill for half the cost of the renovations. Seriously.

The tenant doesn’t have to pay the landlord the money. There are some costs that are simply the costs of doing business, and maintaining the property by replacing windows is just one of many costs this landlord is going to run into.\

If the tenant had broken a window because, I don’t know, there was an intense game of indoor baseball going on, then yes, for sure, the landlord could charge the tenant for the repair and replacement of the window. Or the landlord could charge the tenant when the tenant moved, and keep some of the security deposit to cover the cost.

The Residential Tenancies Act doesn’t actually set out who is responsible for repairs and that’s why sometimes, there is confusion about what repairs the landlord can charge the tenant for, and what repairs the landlord can’t charge for. The common sense approach is that any “big” repairs are the landlord’s responsibility and “teeny tiny” repairs are the tenant’s responsibility. So, while the tenant can change the lightbulb, it’s the landlord that installs the new light fixtures when the old ones break.

There is also the Minimum Housing and Health Standards that can help us to decide who should pay for repairs. One of the landlord’s responsibilities is to make sure that the rental property meets these standards. The standards set out that the windows must be in good repair, free of cracks and weatherproof. So, if the windows in the property do not meet this standard, then it’s the landlord’s job to make sure that the windows get repaired or replaced. If the property is not being maintained, then the tenant can call Environmental Public Health and talk to an inspector about the problem that they’re having with the rental.

What should the tenant do? The tenant should tell the landlord, in writing, that they are not going to pay for the windows. The tenant could put in reasons why they aren’t paying (and while it might be tempting to write that you aren’t paying because the charge is ridiculous, it’s probably better to refrain). Hopefully the landlord will just go away at this point. If the landlord still insists on being paid, then there are three ways the landlord may react.

- The landlord could sue the tenant for half of the cost of the renovation. The landlord is going to have to convince a judge that the tenant should have to pay for the windows, which seems unlikely.

- The landlord could keep the security deposit when the tenant moves out. If the tenant doesn’t agree with a charge made against the security deposit, then the tenant can bring an application in Provincial Court or through the Residential Tenancy Dispute Resolution Service for return of the security deposit.

- The landlord could pass the bill to a collection agency. If the tenant is contacted by a collection agency, then the tenant can inform the agency in writing that the tenant is disputing the debt, and ask that the landlord prove the debt in court. If the tenant does that, then the collection agency cannot contact the tenant any longer. Service Alberta has a tipsheet about dealing with collection agencies.

In the meantime, the tenant might want to think about moving. If the landlord thinks that the tenant should pay for the windows, what else does he think the tenant should pay for?

How to Find Good Legal Information Online

From time to time people call us looking for help finding legal information. Recently I spoke to a woman about an issue she was having with a tenant. We conversed for awhile before I realized that she was calling from Florida. Yikes! We provide Canadian legal information. She’s living under a whole different set of laws and a very different legal system. Her internet search had led her to us and she didn’t even realize that she was calling Canada. That’s the problem with the internet. Good information is available, but you have to be on your toes to check if it is relevant and accurate for your situation.

A Question about Paying with Coins

Question of the month from the Garvie Reading Room:

I had over one hundred loonies in my money jar. I rolled them up and took them to the grocery store. I tried to pay my $100 grocery bill with the loonies, but the cashier wouldn’t let me pay with them. The store manager said that he didn’t have to accept the coins for my purchase. Is that true? My friends say, “Of course you can pay with loonies. They’re legal tender in Canada!”

The law in Canada (specifically the Currency Act) does say that coins issued under the Royal Canadian Mint Act (such as our $1 coins which we affectionately call loonies) are legal tender in payment for purchases. However, the Currency Act also says that there are limits in how many coins you can use in one transaction. Section 8(2) says:

“A payment in coins referred to in subsection (1) is a legal tender for no more than the following amounts for the following denominations of coins:

(a) forty dollars if the denomination is two dollars or greater but does not exceed ten dollars;

(b) twenty-five dollars if the denomination is one dollar;

(c) ten dollars if the denomination is ten cents or greater but less than one dollar;

(d) five dollars if the denomination is five cents; and

(e) twenty-five cents if the denomination is one cent.”

This means that you can’t actually take a hundred loonies to pay for your $100 worth of groceries.

The Currency Act goes on to spell out in section 8(3) that more than one purchase from the same place in one day is considered to be one total amount for the purpose of these limitations. So you cannot try to get clever and divide your $100 purchase into four $25 purchases so you can pay each with your loonies!

That leaves all of us spending our coins a little at a time, or going to the bank to trade them for bills.

You can learn more about the making, use and collection of coins from the Royal Canadian Mint website.

Another bed bug story…

Well, bed bugs in rental housing has come up again, at least in the Edmonton news. There is a lot of information out there that can help you figure out if you have bed bugs, what you should do to deal with them, how you can prevent getting them in the first place, and how you can avoid passing them along to someone else.

Sandra Hamilton, a health inspector with Alberta Health Services, was interviewed on CBC and you can listen to the interview here.

The Edmonton Apartment Association has a lot of information on their website, including the Edmonton Bed Bug Guide, and a Bed Bug Info Sheet.

If you are a renter who thinks you have bed bugs in the rental premises, you can find out which Alberta Health Services, Environmental Public Health office you should contact to receive more information here.

Until next time, while it may be true that no man is an island entire among itself (yes, I have just “Donne” that), the same can’t be said about your bed…

FAQ: Who is Responsible to treat bugs in a rental property?

A Question about Burning Money

Question of the month from the Garvie Reading Room:

Is it against the law to burn or otherwise damage Canadian currency?

Canadian currency consists of both coins and bank notes (the proper name for paper money), and the law treats coins differently from bank notes.

The law for coins is quite specifically spelled out in the Currency Act (R.S.C., 1985, c. C-52) Section 11 (1):

“No person shall, except in accordance with a licence granted by the Minister, melt down, break up or use otherwise than as currency any coin that is current and legal tender in Canada.”

This Act also spells out the penalties for doing so. As if that was not enough, the Criminal Code of Canada (R.S.C., 1985, c. C-46) also has a relevant section:

“456. Every one who

(a) defaces a current coin, or

(b) utters a current coin that has been defaced,

is guilty of an offence punishable on summary conviction.

(By the way, isn’t this an interesting use of “utters”? In this particular section, “utters” means to use for payment or to sell.)

The law regarding bank notes is very different. Neither the Bank Act nor the Criminal Code says anything about mutilation or defacement of bank notes. Before you start scribbling on those twenties in your wallet (or burning them up for that matter), there are some important reasons why you should not damage bank notes. Writing on bank notes may interfere with the security features. As well, damage reduces the lifespan of the notes, which increases costs because then they have to be replaced more frequently. Markings on notes may also prevent them from being accepted in transactions. Furthermore, it is generally thought that marking or damaging bank notes is inappropriate because Canadian paper money is a symbol of our country and source of national pride.

The production of bank notes is one of the main roles of the Bank of Canada. If you do encounter damaged or mutilated bank notes, a free redemption service is offered.

In the end, how many of us actually have “money to burn”?

Photos by Caitlin Thompson at http://www.flickr.com/photos/kittycanuck/

Alternative Voting Systems

Recently, we had a federal election here in Canada, and many people noticed that when all was said and done, the distribution of seats in the House of Commons didn’t very closely match the distribution of votes that each party received. There is a good reason for this, and it has to do with the voting system we use here in Canada, a system known as “First Past the Post” or “Single Member Plurality”. Given the recent election here in Canada, as well as the fact that people in the UK recently engaged in a referendum about whether they should change their voting system (they opted not to), we thought our readers might be interested in a brief overview of how our system works, what some of the alternatives are, and the history of alternative voting systems in Canada.

Single Member Plurality

Here in Canada, we use a system based on the Westminster parliamentary system found in the United Kingdom. The Single Member Plurality system (also known as the “winner take all” system) has the advantage of being very easy to understand. Basically, Canada is divided up into 308 geographical areas (known as “ridings”), and voters in those areas cast a ballot for the candidate that they feel would best represent them. The candidate in each riding who garners the most votes is declared the winner and becomes a Member of Parliament. There are a number of advantages to this system, not the least of which is that it is very simple. People cast one vote, and that vote is directly accounted to a single candidate. Moreover, it allows people to vote for a person who is explicitly responsible for the area that they live in, giving a sense of direct representation.

There are, however, some downsides to this system. Because a candidate only has to get more votes than every other candidate to win, the winner doesn’t necessarily have to get the support of the majority of the voters in their riding. Here is an example from the 2011 election:

| Party | Candidate | Votes | Percentage |

| Conservative | John Baird | 25,226 | 44.7 |

| Green Party | Mark MacKenzie | 2,279 | 4.0 |

| NDP-New Democratic Party | Marlene Rivier | 11,128 | 19.7 |

| Liberal | Anita Vandenbeld | 17,790 | 31.5 |

Notice that Conservative candidate John Baird received the support of less than half of the voters in the riding, but because he received a plurality of votes (more votes than anyone else) he was declared the winner and will represent all of the voters in the House of Commons.

While this might seem somewhat unequal on a local level, the difference is even more pronounced if you look at the results across the entire country. In our political system, the party that wins the largest number of seats is generally the party that forms the government, especially if that party wins a majority of the seats, as the Conservative Party did in 2011. But, just as a candidate can win a riding without the support of the majority of voters, so too can a party win a majority of the seats in the House of Commons without the support of the majority of Canadians. In the 2011 federal election, the popular vote each party received is as follows:

Green Party: 3.9%

Conservative Party: 39.6%

Liberal Party: 18.9%

NDP: 30.6%

Bloc Quebecois: 6.0%

But the actual percentage of seats that each party won was very different:

Green Party: 0.3%

Conservative Party: 54.2%

Liberal Party: 11.0%

NDP: 33.1%

Bloc Quebecois: 1.3%

In fact, if the seats in the House of Commons were distributed proportionally to the votes that each party received, the House would look very different:

Image by Bryan Beca. Click for full size